Investing Cash at All-Time Highs

As I’ve emphasized before, long-term investment success hinges more on how you behave than what you know. That principle becomes especially relevant when you find yourself investing a lump sum from selling a business, receiving a large bonus, inheriting assets, or another one-time event.

When the stock market is at record highs, you also carry the psychological burden of investing after a long run-up. Should you wait for a pullback? Hold your money until the “perfect” entry point appears? Over time, those concerns tend to matter far less than simply staying invested.

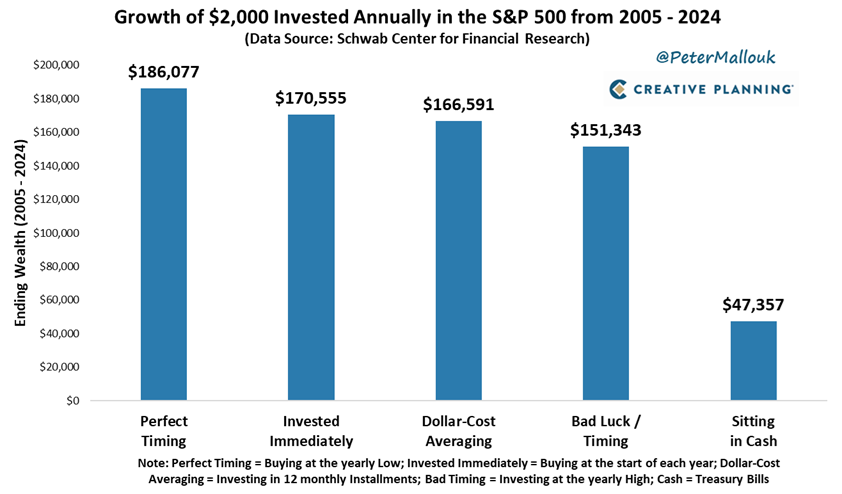

The chart above highlights how $2,000 invested annually in the S&P 500 from 2005 to 2024 would have performed under different timing strategies:

Perfect Timing (always buying at the yearly low): $186,077

Invested Immediately (start of each year): $170,555

Dollar-Cost Averaging (12 monthly installments): $166,591

Bad Timing (always buying at the yearly high): $151,343

Sitting in Cash (Treasury Bills): $47,357

Perfect timing looks like a clear winner. But the bigger takeaway is that the gap between perfect timing and terrible timing is only about 22% over nearly two decades in which your $40,000 investment ($2,000/yr for 20 years) grew by more than 300%.

Compare that with the staggering difference of $100,000 between investing with bad luck and sitting on the sidelines in cash.

This illustrates the powerful point that participation in the market beats perfection in timing. Waiting for the elusive “perfect” entry point can cost investors far more than just getting started and staying the course.

Why timing doesn’t matter as much as you think

Markets trend up over time - Despite bear markets and recessions, the stock market has historically grown over the long run. Missing a few short-term peaks or troughs rarely derails the long-term trajectory.

Compounding needs time, not precision - The earlier you invest, the more time compounding has to work its magic. Even poor timing can’t derail the powerful effects of compounding over the long run.

Perfect timing is impossible - No one consistently buys at bottoms or sells at tops. Strategies built around trying to do so almost always underperform steady, disciplined investing.

Whether you invest immediately, dollar-cost average, or even hit a few unlucky entry points, the outcome is remarkably similar. The biggest mistake is not participating at all. Holding cash for fear of volatility is the true wealth destroyer.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.