Investing at Today’s Elevated Market Prices

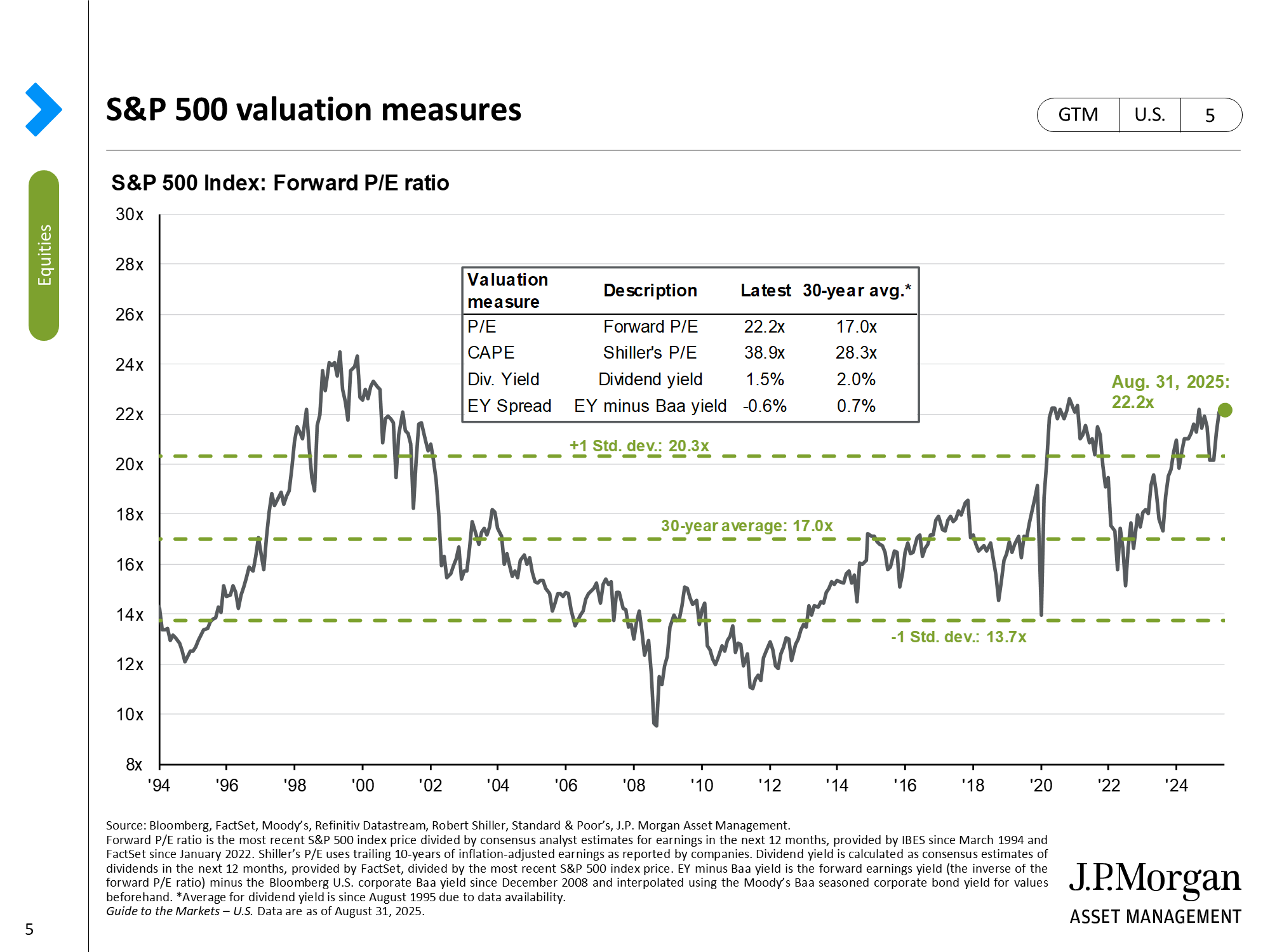

With markets once again touching all-time highs, it’s natural for investors to feel uneasy. I’ve had several recent conversations with clients expressing concern that stocks are “too expensive.” That’s understandable with valuations today more than a standard deviation above their long-term averages.

But valuations alone rarely tell the full story. If you look back to the start of 2020, market valuations were nearly identical to where they stand today. Even so, the market gained over 18% that year and has since climbed 124%.

At first glance, that performance might look like luck. But the data tells a different story. The rally was driven by earnings growth. Since early 2020, about 70% of the market’s rise can be attributed to companies actually earning more money. In other words, corporate profits have increased roughly 70% over that time, and stock prices have followed.

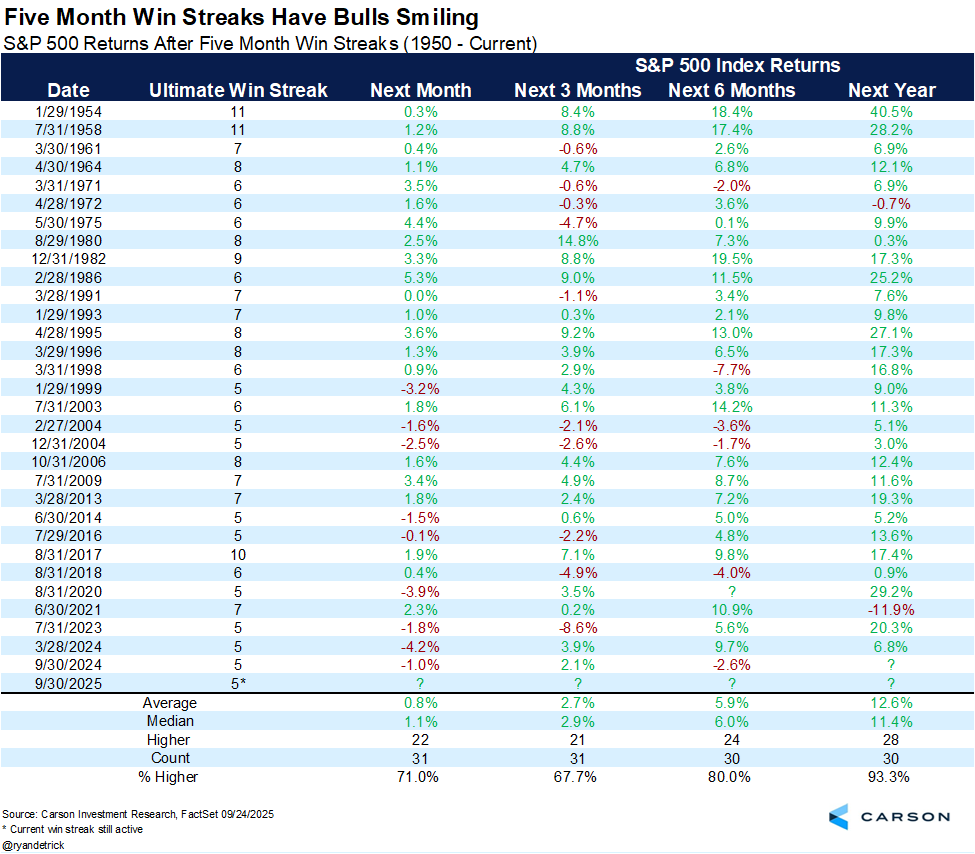

When markets move higher quickly, it often marks the beginning of a broader trend, not the end of one. Through September, the market had posted five consecutive positive months coming off the April lows. Historically, when that’s happened, the market has been higher one year later 93% of the time.

That said, short-term volatility is common. After a stretch of strong gains, the next three months have been positive only about 67% of the time. A bit of profit-taking or consolidation here would be perfectly normal and healthy.

Of course, no trend lasts forever. If earnings begin to decline meaningfully, we could see a more significant downturn. That’s simply the nature of investing - markets are unpredictable, and data is often disproven in real time. Still, history doesn’t support the idea that markets must fall just because valuations are above average. High valuations can persist for long periods of time.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.