International Stocks Still Cheap Relative to the U.S.

After more than a decade of U.S. stock dominance, international stocks outperformed U.S. stocks last year.

That has naturally led investors to wonder, “Did we miss it?”

Even after a period of international outperformance, U.S. stocks remain historically expensive relative to international stocks, and the valuation gap between the two is still unusually wide.

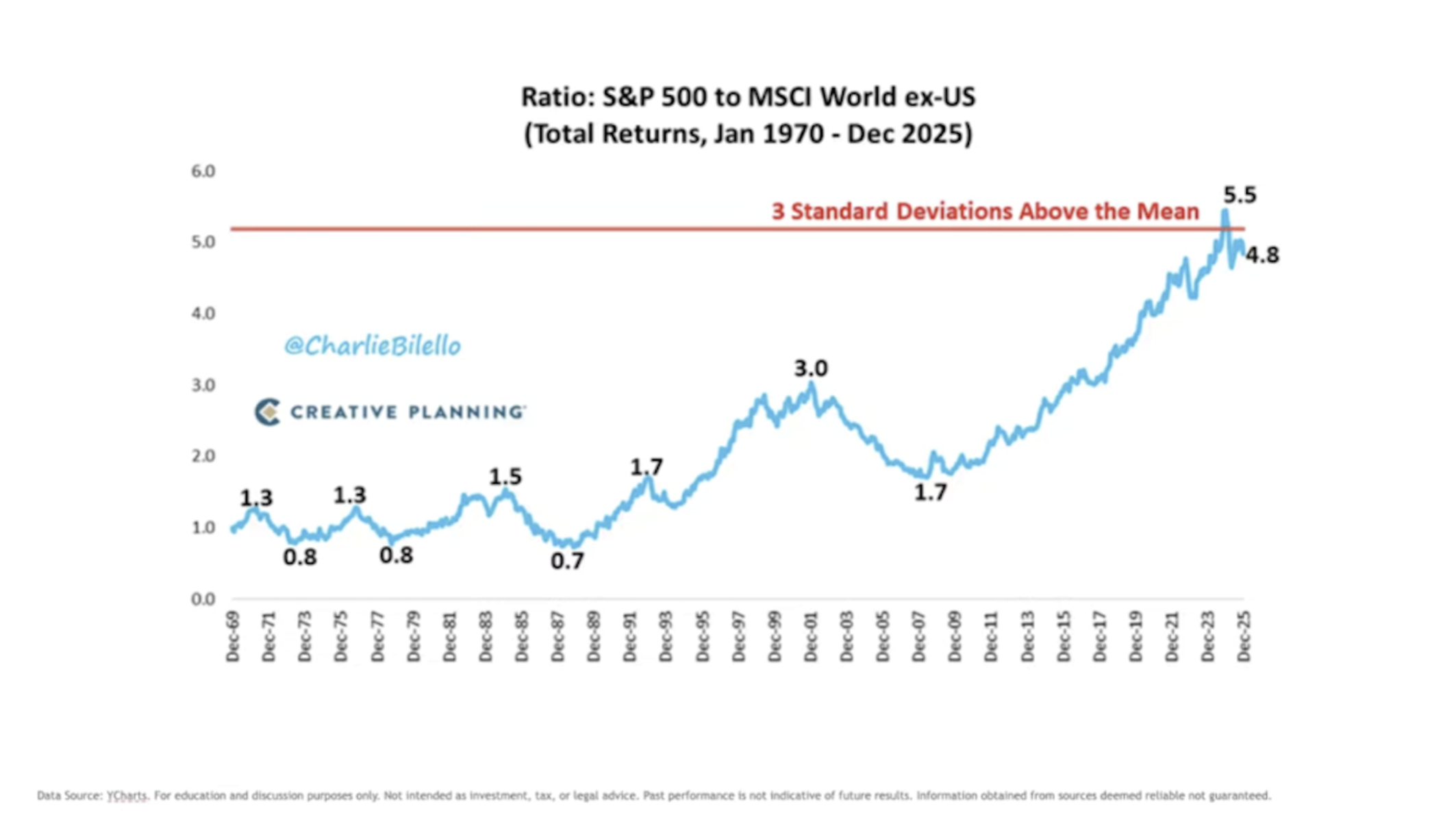

The chart above shows the ratio of total returns from U.S. stocks (S&P 500) relative to international stocks (MSCI World ex-U.S.) going back to 1970.

When the ratio rises, U.S. stocks are outperforming. When it falls, international stocks are outperforming. When it crossed the red line (3 standard deviations), the relative performance of international was in the 99th percentile, meaning that performance relative to the US had been worse in only 1% of historical timeframes.

What stands out is how elevated today’s ratio remains, even after a year in which international stocks returned nearly twice as much as the US.

Prior extremes were followed by long periods where international stocks closed the gap. This doesn’t mean a reversal is imminent, but it does suggest that relative performance has become stretched by historical standards.

It’s important to balance this discussion. There are very real reasons U.S. stocks could continue to outperform:

U.S. companies have delivered stronger and more consistent earnings growth

The U.S. market is more heavily weighted toward high-growth, high-margin sectors, particularly technology

If investor appetite for growth, innovation, and scalability remains strong, capital could continue to favor U.S. equities

The U.S. has earned its leadership, and it could absolutely continue. At the same time, last year’s international outperformance does not mean international stocks are now expensive. Historically, investors tend to abandon international stocks after long periods of frustration, often near relative lows rather than highs.

But the future is unknown, and that uncertainty is exactly why diversification matters so much. Rather than trying to predict which market will win next, investors are often better served by owning a globally diversified portfolio and letting markets do what they do.

Because in the end, the biggest risk isn’t being slightly underweight one region, it’s being overconfident in a future no one can predict.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.