Sometimes, Markets Are Irrational

One of the hardest things for investors to accept is that markets don’t always make sense, at least not in the short term.

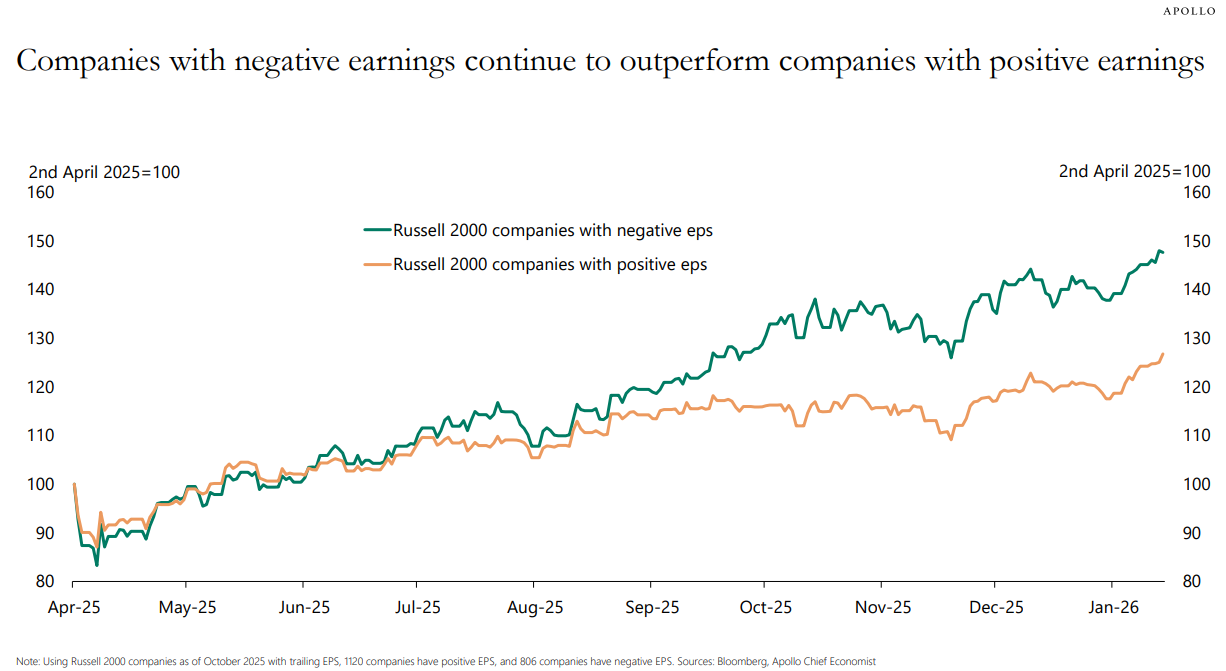

Here’s a good example. Recently, small-cap companies with negative earnings have outperformed those with positive earnings.

On the surface, that feels backwards. Shouldn’t profitable companies do better than unprofitable ones? Maybe. But markets are constantly repricing expectations, narratives, liquidity, sentiment, and more. Short-term outcomes are frequently driven by forces that are difficult, if not impossible, to predict in real time.

This is exactly why we don’t try to outsmart the market or chase whatever appears to be “working” at the moment. What looks irrational today often makes more sense with hindsight. But by then, the opportunity has already passed.

Instead, by owning a diversified, market-like portfolio, we give ourselves exposure to returns that can come from unexpected places.

Markets will continue to surprise us. The discipline is not reacting to every surprise.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.