The Trouble With a Single Data Point

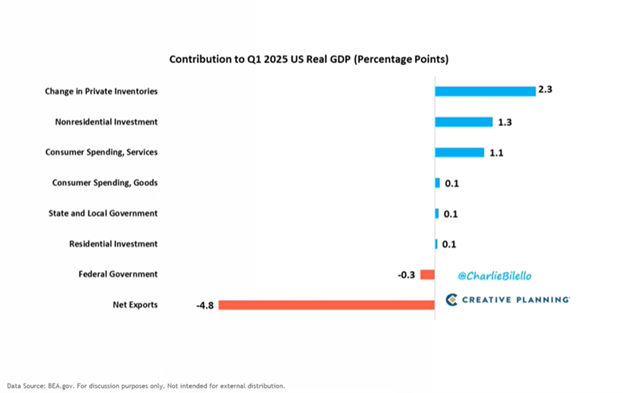

A single headline can move the market, but sometimes, the numbers behind those headlines are more complicated than they appear. The first quarter of 2025 offers a perfect case study. U.S. GDP declined by .3% in Q1, sparking fears of a looming recession. While that may certainly materialize, a closer look at the data shows a different story. The decline was not due to changes in consumer spending or investments, it was due almost entirely by “net exports.” When the US imports more than we export to other countries, it is a drag of growth. We imported significantly more in the Q1 than we exported.

This was likely due to businesses importing large amounts of inventory in anticipation of the tariffs that were later announced in early April.

Adding to that unusual activity, gold imports spiked dramatically in January and February. The problem is that the Atlanta Fed’s GDPNow model, which tracks economic data in real time, treated these gold imports like any other import. Since imports are subtracted from GDP in the official calculation, the model showed a sudden, dramatic drop in expected growth. Fortunately, the official GDP prints usually strip out activity like this.

The point of this post isn’t to take you down an Econ 301 rabbit hole. It’s to illustrate how misleading a single number can be, especially without context. And this doesn’t just apply to economics. One high cholesterol reading doesn’t automatically mean you're unhealthy, nor does a bad weather day ruin a whole vacation. Single data points often tell an incomplete story. It’s the surrounding context and the underlying causes that give us the whole picture.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.