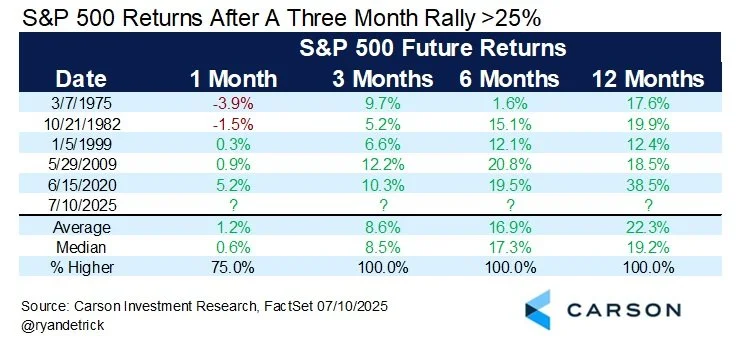

Average Returns Following a Stock Market Rally

Following the Tariff-related sell-off in March and early April, the stock market experienced one of its best rebounds on record, with the S&P 500 rising over 25% from April 4th to July 10th. It’s normal for this kind of momentum to feel unsustainable. But that isn’t what history shows us.

When the market posts big short-term gains, it often doesn’t fizzle out.

Looking at the biggest 3-month rallies in the S&P 500 since 1950 (Source: Carson Investment Research), the average 12-month return is 22% and it has been positive every time. In other words, strong quarters are often followed by more gains, not sharp reversals. That optimism feeds on itself as investors who were sitting on the sidelines start to feel the pressure of missing out.

These numbers don’t guarantee anything, of course. But they do challenge the narrative that markets “have to pull back” after a good run.

On the other hand, the longer-term returns of 4-5 years tend to be below average, suggesting that these periods can create overpriced markets, which can lead to corrections. I think there are several concerning data points, primarily continued jobless claims (people who are looking for jobs are having a harder time finding them). Tariff talk seems to be ramping up again. The housing market is also showing signs of weakness. All of these could be catalysts for some volatility over the coming year.

None of this means blindly chasing returns or ignoring risk. But if your investment strategy is built on discipline, diversification, and long-term thinking, then recent gains are not a reason to change course. If anything, they’re a reminder of why we stay the course.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.