Why Renting Is The Smart Move in Today’s Housing Market

One of the most common conversations I’ve had with clients this year has nothing to do with their finances. It’s about their children’s struggle to enter the housing market.

Many of my clients are in a strong financial position with stable housing and meaningful savings. But they look at the current housing market and worry that their young adult kids, just starting careers or families, are being priced out of homeownership. It’s understandable, given that the cost of homeownership has skyrocketed relative to renting in recent years.

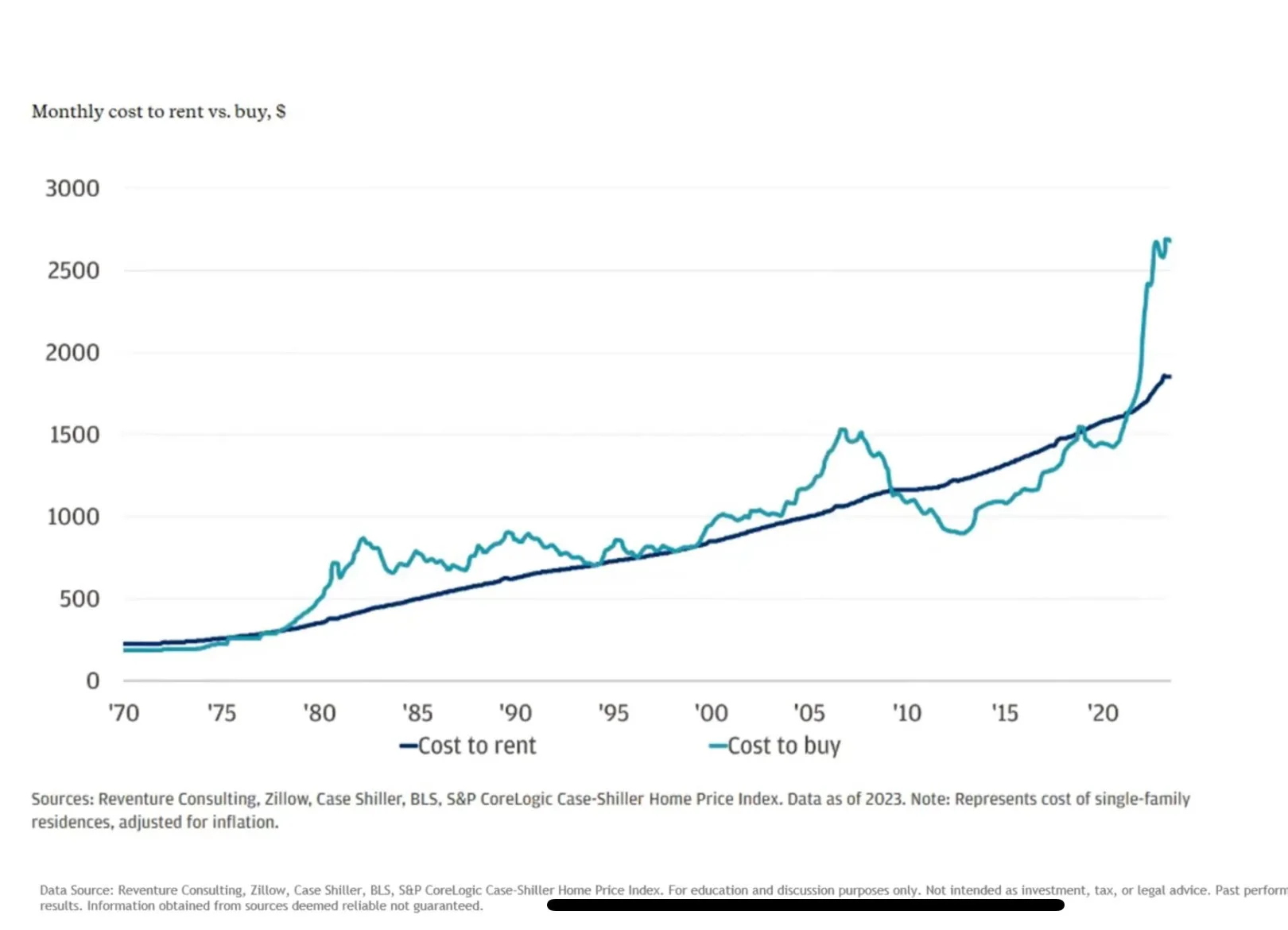

The chart above shows how the monthly cost of buying a home has exploded to the highest level in modern history. The relationship between the cost to buy and the cost to rent has never been more stretched. For decades, the cost lines for renting and buying moved roughly together. But starting around 2020, the cost to buy detached from historical norms. We’re now in a housing environment where mortgage rates remain much higher than in the last decade, AND home prices have not retreated much at all.

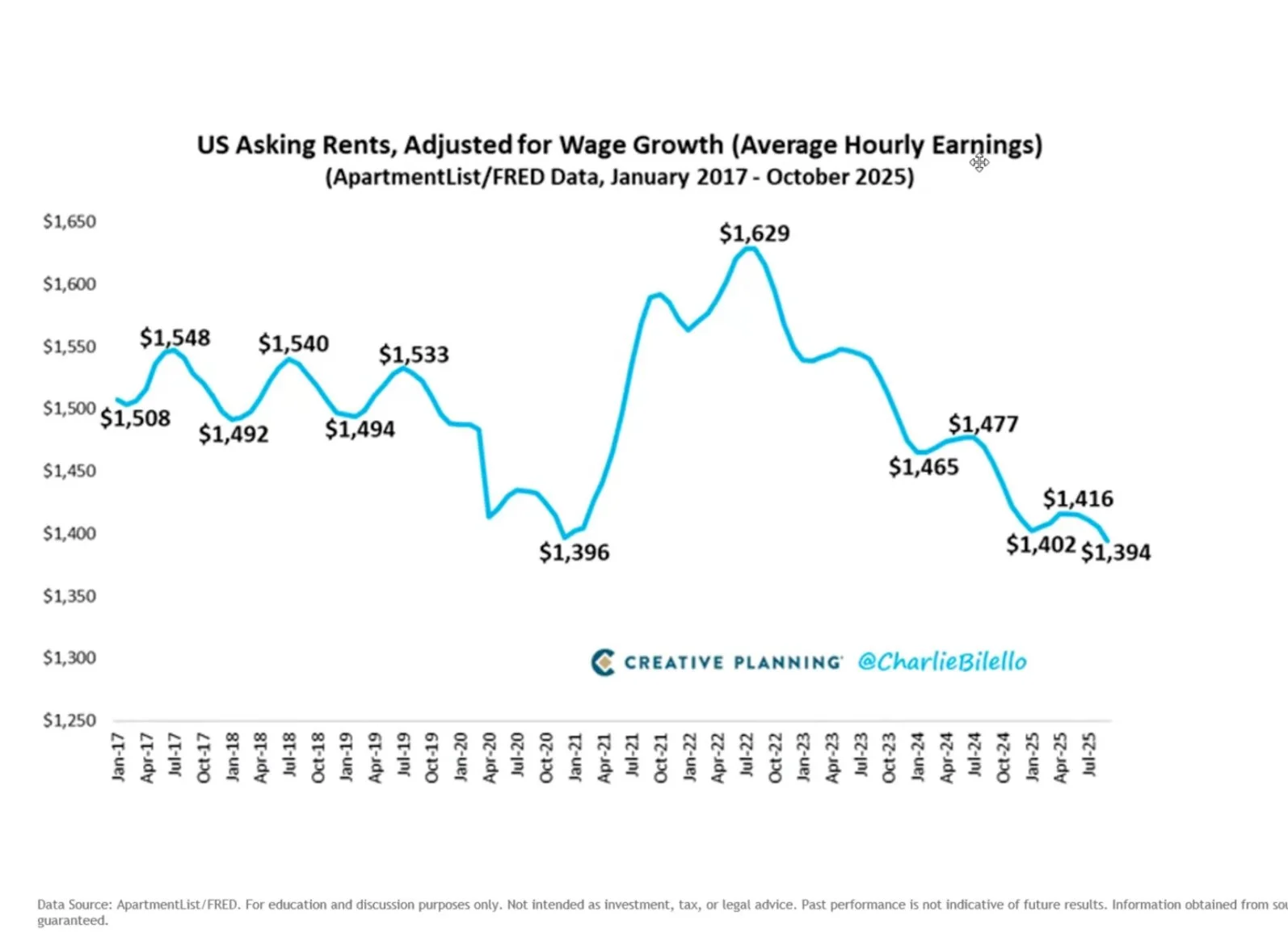

Meanwhile, wage-adjusted rents have softened a lot and are at cylcle lows.

The result is that renting is now much cheaper than buying for most. For generations, buying a home was not only affordable but a reliable wealth-building tool. But the math has changed in recent years.

Renting offers real advantages in the current landscape:

Flexibility in a market with an unpredictable direction.

If prices flatten or decline, renters can take advantage.

Lower monthly expenses, and that cash flow difference can go into investments or debt payoff.

No repair bills, surprise assessments, or property tax hikes.

So What Should Young Adults Do?

1. Rent strategically. Choose a place that keeps fixed costs manageable. Prioritize savings rate over square footage.

2. Save for optionality. Your child may choose to buy later.

3. Invest consistently. If history is any guide, long-term market returns will outpace the equity they’d be building in a house.

4. Wait patiently. The market will shift, and there will be a time when buying makes more sense.

Of course, if you are financially able to buy, there are many non-financial reasons to own. And every geographic area is different, so there are many pockets in the US where buying could make sense. But on the whole, renting has never made more financial sense than it does right now.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.