The Stock Market Isn’t as Random as It Looks

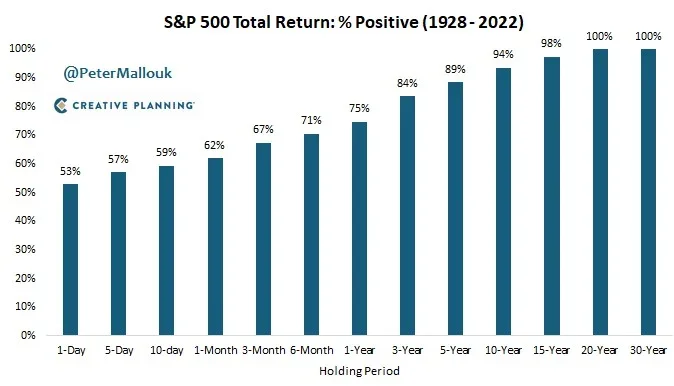

If you log into your financial accounts every day, the stock market will feel quite random. Up, down, sideways, completely unpredictable. You only have about a 50/50 chance of seeing green on any given day, 53% to be exact (see below).

There are about 250 trading days in a normal calendar year, which means that for 120 days every year, you will log in and see that your investments are down. Even the most resilient investor will feel the weight of that. And given that most people have a loss aversion bias, where the losses are remembered and the gains are easily forgotten, this type of activity is likely to lead some investors to throw in the towel.

As you check less often, the likelihood of a positive return increases - 75% positive over any 1 year. I don’t think anyone would or should check less often than that, but it’s comforting to know that over 5-10 years, the likelihood of a negative return becomes small. Over 20+ years, it has never been negative.

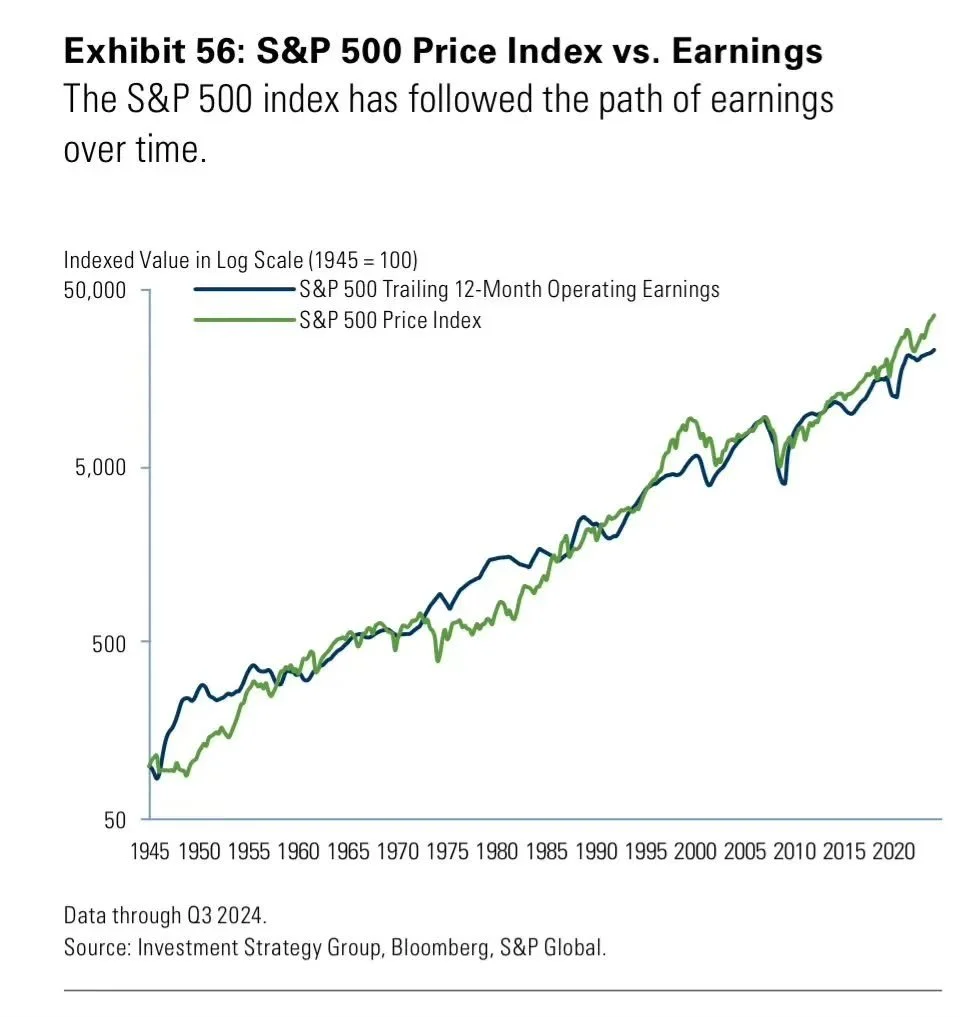

As you stretch out your view over years or decades, it’s easy to see why this is the case. Stock prices follow earnings.

Since 1945, the S&P 500 (light green) and S&P 500 Trailing 12-Month Operating Earnings (dark green) have moved together in remarkable harmony. They drift apart occasionally during bubbles and crashes, but in the long run, prices keep coming back to where earnings are headed.

This is how it should be when you’re investing in companies. As their earnings grow, they become more valuable. Corporate America makes more money over time, and investors are willing to pay for that growth.

Most of the short-term movements in the stock market are just noise that will mean very little a week or month from now. But if you check too often, most of your attention will be spent on this noise and not the more important questions like “Is my allocation still on target and is my financial plan on track?”

In the age of instant information, remember that checking your investment accounts more frequently does not necessarily lead to better investment outcomes. It often has the opposite effect, amplifying the emotional and behavioral biases that can hinder long-term success. Successful investing is a marathon, not a sprint, and it requires patience, discipline, and a focus on long-term goals.

Happy Planning,

Alex

This blog post is not advice. Please read disclaimers.